Thumbs Up for Forgetting Your Wallet at the Supermarket Check Stand

The Smarter Gun May Resolve a Long-Standing Policy Debate

December 31, 2016

It’s a Bat! It’s a Robot! It’s a Robat!

February 11, 2017Thumbs Up for Forgetting Your Wallet at the Supermarket Check Stand

It’s a scenario you know well: you visit a grocery store, spend time selecting groceries, then finally approach the light at the end of the tunnel: the checkout stand.

It’s a scenario you know well: you visit a grocery store, spend time selecting groceries, then finally approach the light at the end of the tunnel: the checkout stand.

The cashier scans all of the items, and then it’s time to pay. You reach into your pocket, and panic:

Your wallet isn’t there.

Embarrassed, you explain you don’t have your debit card, and that you can’t pay for your food-filled cart. Grumpily, the associate calls someone from the back to put away all of your items.

This is a scenario that many of us have experienced at least once.

Wouldn’t it be great to have access to your money, no matter what?

One big company is doing just that.

In 2015, Mastercard revealed it’s biometric program. This experimental app lets you pay for online purchases with either a selfie or your fingerprint.

While you can’t use this to buy your groceries at your local Wal-Mart quite yet, this technology is the precedent for allowing such technology to become mainstream. MasterCard boasts a consumer trial in the Netherlands where their program outperformed traditional competitors in both convenience and security.

While you can’t use this to buy your groceries at your local Wal-Mart quite yet, this technology is the precedent for allowing such technology to become mainstream. MasterCard boasts a consumer trial in the Netherlands where their program outperformed traditional competitors in both convenience and security.

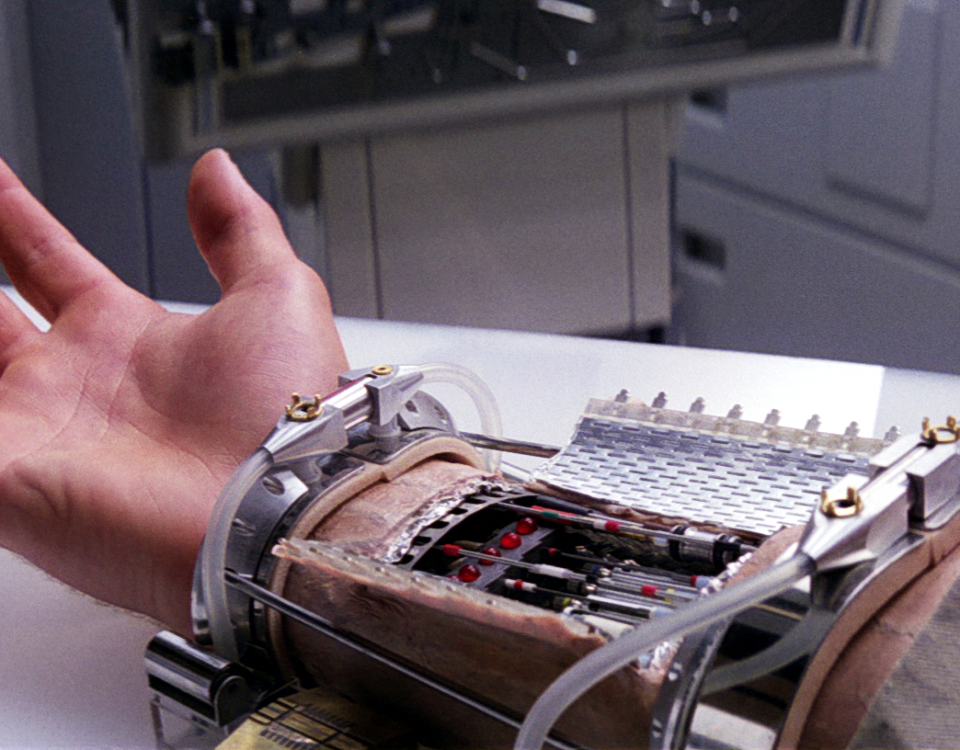

Using your fingerprints to pay for everyday goods and services started out as a work of fiction, appearing in films such as Arnold Schwarzenegger’s “The Sixth Day”.

However, this technology is rapidly becoming a reality, and may one day very soon become commonplace in our day-to-day lives.

Eric Cawley is an occasional blogger for Gary Stringham & Associates. Gary provides consulting and expert witness services in embedded systems such as biometric devices. Feel free to contact Gary at 208-939-6984.